At Payslip Plus, we understand the importance of precise and authentic documentation for your financial records. Our services are designed to provide genuine replacement payslips and P60s, ensuring you access the accurate documents you need for verification and compliance purposes. We strictly adhere to legal standards and do not deal in fake payslips or fraudulent documentation.

Reliable Documentation Backed by Real Payroll Knowledge

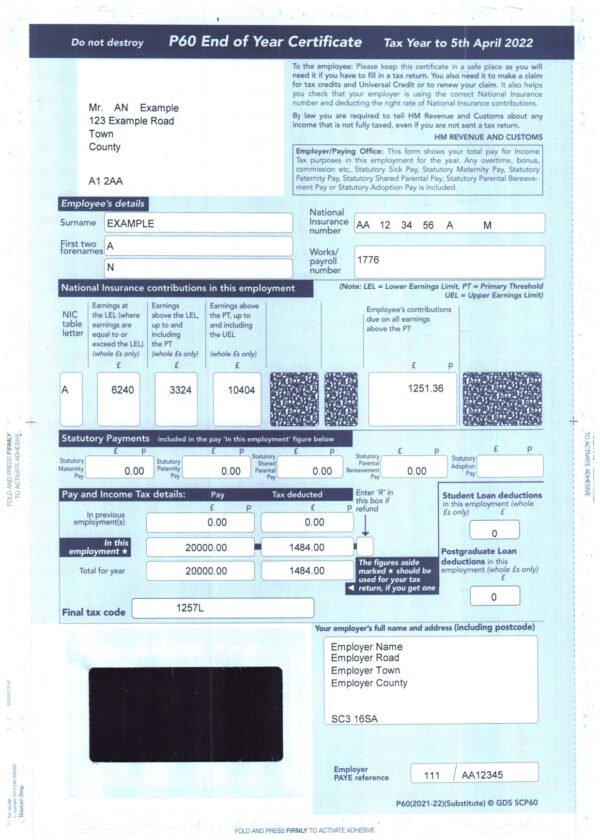

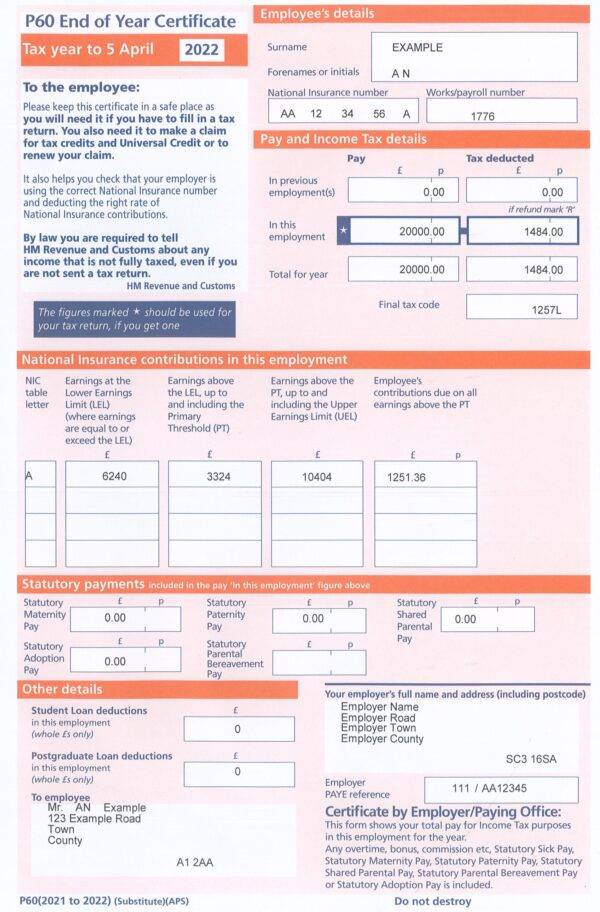

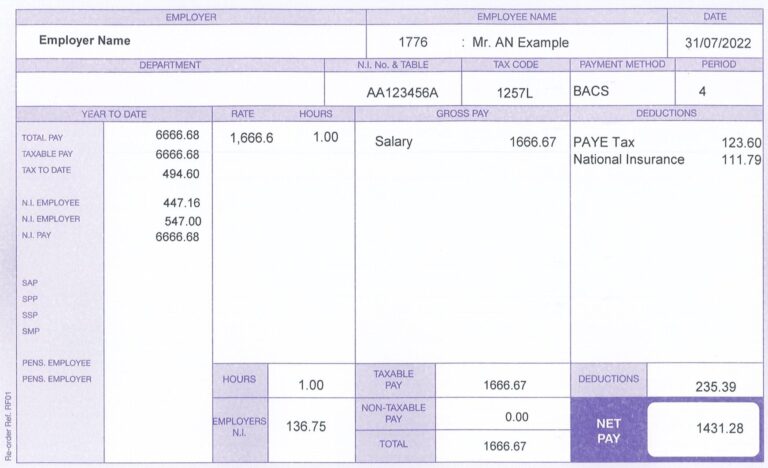

At Payslip Plus, our service is built on a clear understanding of UK payroll processes and verification requirements. We produce replacement payslips and P60s using accurate figures provided by you, presented in professional formats that reflect standard UK payroll layouts. We do not create fake or misleading documents, and we only support lawful use for record-keeping, verification, and compliance purposes. Your information remains private and under your control, with no automatic sharing to HMRC or third parties. This approach ensures you receive dependable documents while maintaining full responsibility over your personal and tax records.

Please note that we prioritize your privacy and confidentiality. We do not share your personal data or payslip information with HMRC or any other third party. It is your responsibility to update HMRC, your employer, or your employee with any relevant information regarding your financial and employment status.

Order your old payslips p60 here same day delivery

Step-by-Step Guide to Getting Your P60 from Our Website:

- Visit Our Website: Open your preferred web browser and go to the official Payslip Plus website at payslips-plus.co.uk

- Navigate to P60 Services: Once on our website, locate the “P60 Services” section. This is where you’ll find everything related to obtaining your genuine P60.

- Select Your P60 Type: Choose the type of P60 you require. We offer replacement P60s to match your specific needs.

- Provide Required Information: Fill in the necessary details, such as your name, contact information, and relevant employment details. This information helps us generate a personalized and accurate P60 for you.

- Review and Confirm: Double-check the information you’ve provided to ensure accuracy. This step is crucial to ensure your P60 contains the correct data.

- Payment: Make the required payment for your chosen P60 service. We offer secure payment options to ensure your financial information remains protected.

- Processing and Delivery: Once payment is confirmed, our dedicated team will process your request promptly. Your genuine P60 will be generated with precision and care.

- Accessing Your P60: You will receive an email notification when your P60 is ready. Simply log in to your Payslip Plus account and navigate to the “My Documents” section. There, you’ll find your authentic P60 ready for download

If you have any issues or questions, contact the company’s customer service for assistance.

If you have been unemployed for an extended period, you might not have received any form of income, leading to concerns about obtaining a P60 while unemployed. A P60 form is typically issued by employers to their employees at the end of the tax year, summarizing the total income earned and taxes paid. However, if you are unemployed, recently arrived as a new immigrant, or have been in the country for less than 12 months, you may not have access to this form.

It’s important to note that P60 forms are only available to those who are currently employed, and they are not automatically provided to individuals who are unemployed. Given this, we have created a comprehensive guide to help you understand how to manage your financial documentation and what steps you can take to handle the absence of a P60 if you are unemployed.

how to get a P60 if unemployed?

The P60 form is used to calculate the amount of tax that you owe. The first step is to enter your personal details into the system. These details include:

- your name

- your address

- the date that you were born

- your National Insurance number

- your gender

- your date of birth

- the amount of tax that you have paid

- the amount of tax that you have paid in excess

If you have not filed your P60 form recently, it’s important to complete this process promptly. Start by reviewing the details you have entered to ensure accuracy. Next, calculate your total earnings by inputting your monthly gross income. If you are self-employed, you can find this information on your self-assessment return.

For members of a small company or partnership, this information should be available in your latest annual return, which can typically be accessed online. If you are employed by a larger organization, you may need to request this information from your employer directly.

Additionally, verify the amount of income tax you have paid by examining the relevant section on your pay slips. This will help ensure that your P60 form accurately reflects your tax contributions and earnings.

Do you get a P60 if you are not working?

If you are not employed by a company, you will not receive a P60. Unlike other forms, you cannot simply sign up to obtain a P60; it must be applied for, and there may be a fee involved. Additionally, you need to be registered as a self-employed individual to be eligible for a P60.

If you are registered as self-employed, you will need to provide proof of this registration to a PUC (Pay and Tax Compliance) agent. This includes presenting your tax returns and a copy of your business license. The application process can be completed online.

It’s advisable to apply for a P60 before you lose your job. If you already have a P45, you might be able to use it during what is known as the “retention period.” This period allows you to continue using your P45 if you have been out of work for less than three years.

However, if you have been unemployed for three years or more, you may face challenges in renewing your P45, as it might not be possible after such an extended period.

Conclusion

Understanding how P60s and payslip replacements work is essential for managing your financial records, especially if you are changing jobs, applying for credit or maintaining accurate tax information. Payslips Plus provides a reliable way to access professionally formatted replacement payslips and P60s that meet UK standards, helping you keep your documentation complete and compliant.

Whether you are replacing old records, managing paperwork after unemployment or preparing documents for verification, having accurate wage information puts you in control. Our service ensures your details remain private, secure and easy to access whenever you need them.

If you ever face uncertainty about your documents, our team is available to guide you step by step and help you get the correct paperwork without delays.

Frequently Asked Questions

Do I get a P60 if I am unemployed?

No. A P60 is only issued by employers at the end of the tax year. If you are unemployed, you will not receive a P60 unless you recently had employment before your period of unemployment.

Can I get a replacement P60 if I lost mine?

Yes. You can request a replacement P60 from your previous employer or order a professionally recreated version through Payslips Plus if you need a compliant document for verification.

Does Payslips Plus inform HMRC about my documents?

No. Payslips Plus does not share your information with HMRC or any third party. It is your responsibility to update HMRC or your employer if your personal or financial details change.

What if my employer refuses to give me a P60?

Employers must keep payroll records for several years and can normally reissue old documents. If they cannot provide one, you can order an accurate replacement from Payslips Plus.

Is a replacement P60 legal for verification?

Yes. Replacement P60s created by Payslips Plus follow standard formatting and are designed for verification, tenancy checks, loan applications and general financial record-keeping.

Can I order a P60 even if I worked years ago?

Yes. As long as you provide the correct details, you can request a replacement P60 from any previous tax year that you need for your records.

How fast can I receive my replacement P60?

Payslips Plus offers same-day digital delivery for urgent requests. Once processed, you can download your document directly from your secure account.

Do I get a P60 if I’m self-employed?

No. Self-employed individuals do not receive P60s from HMRC. Instead, your proof of income comes from your Self Assessment tax return (SA302) and tax year overview.

Can I use a P45 instead of a P60?

A P45 only shows your earnings up to the point you left a job. A P60 summarises your entire tax year. In some cases, a P45 may be accepted temporarily, but a P60 provides a fuller record.

Can P60s be used for rental or loan applications?

Yes. Many landlords, banks and letting agents accept P60s as proof of income. Replacement copies from Payslips Plus are suitable for these purposes.