Finding a P60 Online can feel confusing for many employees across the United Kingdom, especially when tax season arrives or when someone needs proof of income for things like mortgage checks, rental applications, or visa paperwork. This guide explains everything in a clear way so that anyone from students in Manchester to families in London can understand every step with confidence. You will learn where to find your P60, how to get it online, what to do if you lose it, and how services such as Payslips Plus help thousands of workers across the country.

Order your payslips p60 here same day delivery

What Is a P60 and Why You Need It in the UK

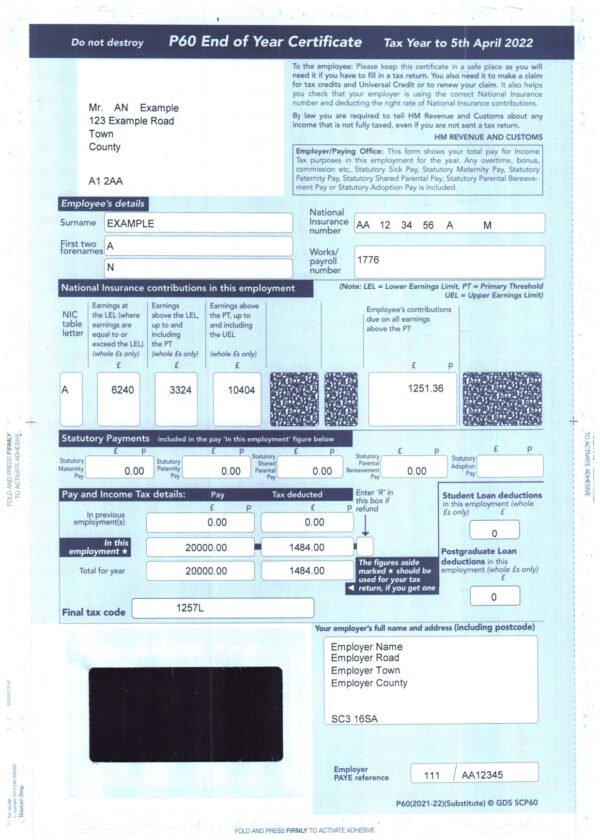

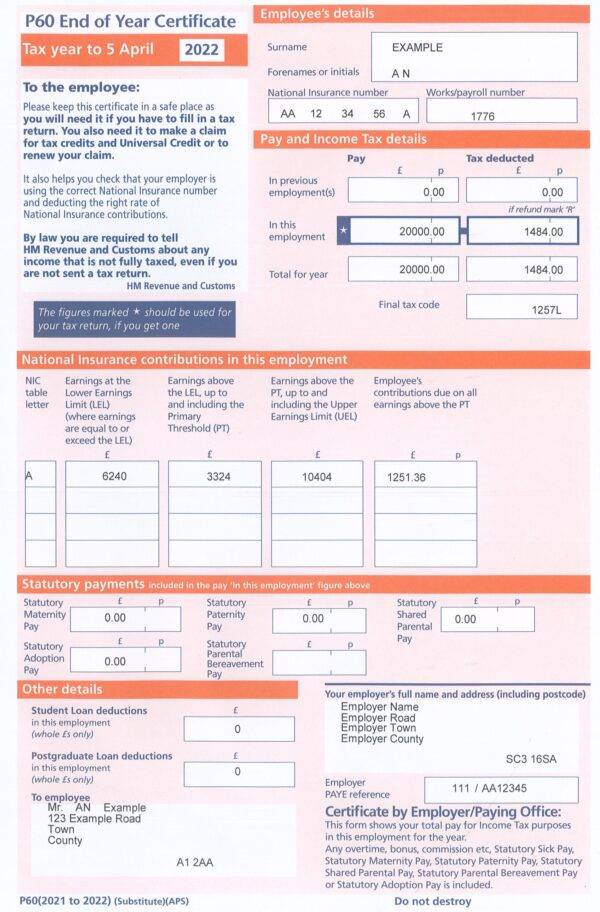

A P60 is an official end-of-year tax document that summarises your total earnings and the amount of income tax and National Insurance you paid during the tax year. Every employee in the United Kingdom should receive their P60 from their employer after the tax year ends in April. It acts as an essential record for proving your income, checking whether your tax has been calculated correctly and confirming any deductions taken throughout the year.

Across the UK, lenders and financial institutions often rely on a P60 as reliable proof of earnings. Whether you’re applying for a bank loan in Birmingham, opening a new credit account in Leeds or completing affordability checks in Glasgow, lenders typically request a P60 to verify your annual income. Landlords in high-demand areas including major cities and well-known locations like properties near the London Eye may also ask for a P60 before approving a tenancy.

Understanding what a P60 is and why it matters can save you time, prevent financial delays and help you avoid problems with applications that require verified income. A clear grasp of this important document also ensures you’re prepared when banks, letting agents or government departments request wage evidence as part of their checks.

What Exactly is a P60 and Why Do You Need It?

Think of a P60 End of Year Certificate as your job’s annual report card. Your employer is required by law to give you one after the end of each tax year (which runs from 6 April to 5 April). You should receive it by 31 May.

This single piece of paper is very important because it summarises:

- Your total pay from that job for the year.

- The total amount of Income Tax you paid through PAYE (Pay As You Earn).

- The National Insurance contributions you made.

- Any statutory pay, like maternity or sick pay.

You absolutely need this document. It is the main proof of income that lenders request for mortgage applications and loan applications. It is also essential for filling out a Self Assessment tax return or claiming a tax rebate from HMRC. Without it, proving your earnings is very difficult.

Where to Find Your P60 Online: The Official Methods

Before you worry, your P60 Online might just be hiding in a place you have not checked yet. Here are the main places to look.

Check Your Employer’s Online System

Most modern companies no longer issue paper documents. Instead, they use an online payroll system or an employee portal. Log in to the system you use to check your regular payslips. There is usually a section for “Documents” or “Tax Information” where you can view and download P60 forms from previous years. This is the fastest way to find it if you are still with the same employer.

Contact Your Current or Previous Employer

If you cannot find an online portal, the next step is to talk to the company directly.

- Current Employer: Just ask your payroll department or HR department. They can easily print a copy or email you the file.

- Previous Employer: This is where it gets tricky. By law, they must keep your payroll records for three years. You can email or call their payroll office to request a copy. Some are helpful, but others can be slow, or the person you knew might have left.

Log Into Your HMRC Personal Tax Account

This is a very useful tool for all UK residents. You can create or log in to your HMRC personal tax account on the GOV.UK website.

Inside, you will not find a picture of your official P60 form, because HMRC does not issue them (your employer does). However, you will find all the same information. The account shows your employment history, the pay you received, and the tax you paid for each job. For many applications, a printout of these details from your HMRC account is a good substitute for a lost P60.

The Big Problem: What If You Still Cannot Get It?

This is the paint point that causes the most stress. What happens when the official ways do not work?

- Your old employer has gone bust or closed down.

- The payroll department is not responding to your emails.

- You need the P60 today for a deadline, not in two weeks.

- You are self employed but used to be employed and need old records.

This is a real headache, whether you are in London trying to secure a flat near The Shard, or sorting out a car loan up in Manchester near Old Trafford. You need your proof of earnings, and you need it now.

Your Simple Solution: Get a Replacement P60 with Payslip Plus

When you are stuck and the clock is ticking, our service is here to help. At Replacement payslips | Payslip Plus, we specialise in creating high quality, accurate replacement P60s.

We understand what you need. Our system is built to produce documents that correctly show your earnings and deductions based on the figures you provide. It is a straightforward, no fuss service. This is not just helpful for a lost P60. We can also help you Generate Payslips Online, giving you a complete picture of your earnings. If you are missing a full set of records, perhaps for a landlord check or a visa application, we can help you get your paperwork in order quickly.

Common Mistakes: P60 vs P45 vs Payslips

It is easy to get these UK tax documents mixed up. Here is a simple way to remember them.

- Payslip: You get this every time you are paid (weekly or monthly). It shows your pay and deductions for that single period.

- P45 (Details of employee leaving work): You only get this when you leave a job. It shows your total pay and tax from that job up to your leaving date. You give this to your new employer.

- P60 (End of Year Certificate): You get this once a year (around May) if you are still working for an employer on 5 April (the last day of the tax year). It shows your total pay and tax for the entire year from that one job.

You need your P60 to prove your annual income. A P45 or a pile of payslips often is not enough for a mortgage application.

Why Choose Payslip Plus for Your Documents?

We built this service for UK residents just like you. We have extensive experience in understanding PAYE and payroll information. Our entire focus is on providing accurate, professional replacement documents. Whether you are near the Bullring in Birmingham or anywhere else in the United Kingdom, getting your financial paperwork sorted should be simple.

Our service is trusted because we are clear about what we do. We provide replacement documents based on the information you give us. Our Replacement Payslips and P60s are created to be clear, accurate, and just what you need to move forward with your application. We pride ourselves on a fast, reliable service that solves your problem without adding more stress.

Common Problems People Face When Finding Their P60 Online

You lost access to your employer portal

This happens often when you change jobs. Many workers across busy cities such as Birmingham or Glasgow lose their old login details. You can request a reset or contact payroll directly.

You lost the paper P60

Paper documents are easy to misplace during house moves or when sorting bills. Online copies solve this problem.

Your employer does not respond

Small businesses sometimes take time to reply because they manage many tasks. This is when online help becomes very useful.

You left your job many years ago

Old employers may not keep digital records forever which is why online services are helpful for quick solutions.

Frequently Asked Questions

How do I get my P60 from a company that has closed?

If the company is gone, you cannot get an official document from them. Your best option is to check your HMRC personal tax account for the figures. If you need a physical document, you can use a service like Payslip Plus to create a replacement P60 using those figures.

Can I get a P60 from HMRC?

No, HMRC does not give you an actual P60 Online. Only your employer can do that. However, your HMRC online account does show all the same financial information, so you can see your pay and tax details there.

How far back can I get a P60?

Your employer must keep records for 3 years. Your HMRC account may show records going back further. Our service at Payslip Plus can also help you generate documents for previous tax years if you have the correct earning details.

What do I do if I have lost my P60?

First, check your employer’s online portal. Second, ask your payroll department for a copy. If those fail, log in to your HMRC account to get the numbers. If you need a replacement document fast, you can use a replacement P60 service.

Is a replacement P60 an official document?

A replacement P60 is a document that accurately reflects your earnings and tax information. It serves as a substitute when the original is lost. It is vital you use accurate figures when creating one.

Can I use a P45 instead of a P60 if I no longer have one?

Yes, in some situations. A P45 shows your pay and tax up to the date you left a job, while a P60 shows totals for the full tax year. If you left employment before the tax year ended, a P45 may be accepted as supporting evidence, but it does not fully replace a P60.

Why might someone ask for a P60 instead of bank statements?

A P60 is an official year-end summary of earnings and tax paid, making it easier for lenders, accountants, and authorities to verify income without reviewing multiple monthly bank transactions.

Final Words

Finding your P60 should never feel confusing or stressful. Whether you are in London, Manchester, Edinburgh or any other part of the United Kingdom, knowing how to get your P60 online gives you control over your financial records. Life becomes easier when you can quickly show proof of income for loans, rentals, school admissions or visa processes. Services that support accurate payroll documents help thousands of people stay organised and confident every year. If you ever need help restoring your records or keeping your documents safe, platforms that offer Replacement Payslips can guide you with clarity and trust.