A P60 is one of the most important end-of-year documents for any employee. It proves your earnings and tax paid, supports loan or mortgage applications, and helps resolve tax queries with HMRC. Because it is so essential, many people panic when theirs goes missing or was never issued by a previous employer. The common question that follows is simple: can I get a copy of my P60 from HMRC?

How the original P60 was created and who holds the payroll records. In this guide, we break down everything in a clear, easy way so you know exactly what to do next. You’ll also learn practical alternatives such as requesting P60 payslips, replacing lost wage payslips, or using trusted providers like Payslips-Plus for duplicate payslips or replacement payroll documents when needed.

Let’s start with the basics.

Order your payslips p60 here same day delivery

How to get my p60 from our website

- To request a P60 online or replacement payslips, simply click on the link below, fill in the required details, and proceed

- You can also explore our homepage for additional payslip services.

If you need a physical or digital copy of your P60, you can either order one directly from our Website by using the button below or contact HMRC’s helpline at 0300 200 3300. Be prepared to provide your National Insurance number and your employer’s PAYE reference number for verification.

How to get p60

From Your Current Employer

This is the easiest and most common way. Your employer is legally required to give you a P60 by 31 May each year (if you were working for them on 5 April, the end of the tax year).

- Check Your Online Portal: Most companies now issue P60s digitally. Log in to your company’s payroll website or employee portal (the same place you check your payslips). Look for a section called “Documents” or “Tax Information.”

- Check Your Email: It might have been emailed to you as a password-protected PDF. Search your inbox for “P60.”

- Ask Payroll/HR: If you cannot find it, simply email or call your payroll or HR department. Ask them, “Could you please send me a copy of my P60 for the [insert year] tax year?” They can usually re-send it to you or print a copy.

From Your Previous Employer

If you need a P60 from a job you have left, you must contact that company’s payroll department.

- Companies are legally required to keep payroll records for several years, so they should be able to provide a copy.

- Be polite and have your National Insurance number and the dates you worked there ready.

What If I’m Receiving a Pension?

If you are receiving a workplace or private pension, your pension provider acts as your “employer.” They will send you a P60 for your pension income, usually through their online portal or by post.

Misplacing your P60 can lead to delays in financial processes, such as filing a tax return or applying for a mortgage. In such cases, contact your employer for a replacement. If a replacement isn’t available from them, you can also access your tax account online to view or print the P60 details. HMRC can provide a summary of your earnings, though it is not an exact duplicate of the original P60 and may take a few weeks to arrive.

How to order p60 online

At Payslips Plus, we are dedicated to providing a wide range of services, including hassle-free online P60 generation. As a trusted provider of payslips and P60 forms in the UK, we understand how crucial these documents are for both employers and employees for tax and payroll purposes.

Our online P60 generation service streamlines the process, making it efficient for employers to create and distribute P60 forms. With just a few simple steps, employers can generate accurate P60s for their employees, eliminating the need for traditional manual paperwork and saving valuable time in payroll management.

Employees also benefit from our online P60 services by having easy, secure access to their tax documents through our protected online portal. This means employees can access or retrieve their P60 forms anytime they need them, providing peace of mind even if the physical copy is misplaced or lost.

The advantages of using our online P60 service are significant. Employers can simplify their payroll operations and reduce administrative workload, while employees have a straightforward way to obtain their P60s for tax filing, income verification, or other needs.

At Payslips Plus, we place a high priority on data privacy and security. Our platform employs advanced encryption and robust security protocols to safeguard all sensitive employee data. We adhere to strict data protection regulations, ensuring the confidentiality and safety of our clients’ information.

If you are seeking a dependable and efficient solution for generating P60 forms online, Payslips Plus offers the expertise and tools to assist you. Visit our website at payslips-plus.co.uk to discover more about our comprehensive services and how we can fulfill your payroll and P60 generation needs effectively.

Lost p60 payslip

If your P60 payslip is lost, request a replacement from your employer—they are required to provide one by law. If your employer cannot assist, contact HM Revenue and Customs (HMRC). They may provide a copy if it’s on file, but this process can take time.

PAYE reference number not on payslip

We understand the inconvenience caused by a missing PAYE reference number on your payslip and apologize for any confusion this may bring. The PAYE reference number is vital as it uniquely identifies your employer’s PAYE (Pay As You Earn) scheme with HM Revenue and Customs (HMRC). This reference is essential for processing your income tax and National Insurance contributions accurately.

To resolve this issue, we recommend that you directly contact your employer or payroll department. They can provide the correct PAYE reference number for your records. Additionally, inquire about why this reference might be missing from your current payslip and request that it be consistently included in future documentation to prevent any discrepancies.

If you need more information or further assistance, our customer support team at Payslips-Plus is here to help. We are committed to addressing any issues you may have with your payslip or PAYE reference number to ensure a smooth experience.

How To Get p60 From Old Employ?

If you are missing your P60 form, employers should have a duplicate copy, even if it is marked as ‘Duplicate.’ However, if you need a P60 from over three years ago and your employer is unable or unwilling to provide one, you can request a “Statement of Earnings” from them instead.

Even if you no longer work for the company, they are still obligated to assist you in retrieving this document. Politely reach out via phone or email to request a copy, mentioning that HMRC has advised you to contact them directly for this information (as stated on the official .gov website). If there is no response, follow up after seven days and consider contacting HMRC to help recover any outstanding information.

It’s often best to start by contacting your employer, as this process should be free of charge. Modern payroll software typically allows for easy access to such records, and HMRC encourages employers to be supportive in these situations. However, there could be instances where obtaining a P60 is more challenging, such as if the company has gone out of business, you have lost contact, or there have been delays in their response. In such cases, you may receive a printout or photocopy instead.

Employers may no longer have the original stationery required for issuing an exact duplicate, so a digital printout is often the most likely option. Original P60 forms typically have pre-printed year-end dates and are produced on specific forms. If your employer requires support in generating older P60 documents, we at Payslips Plus are happy to assist by providing the necessary paperwork to your organization.

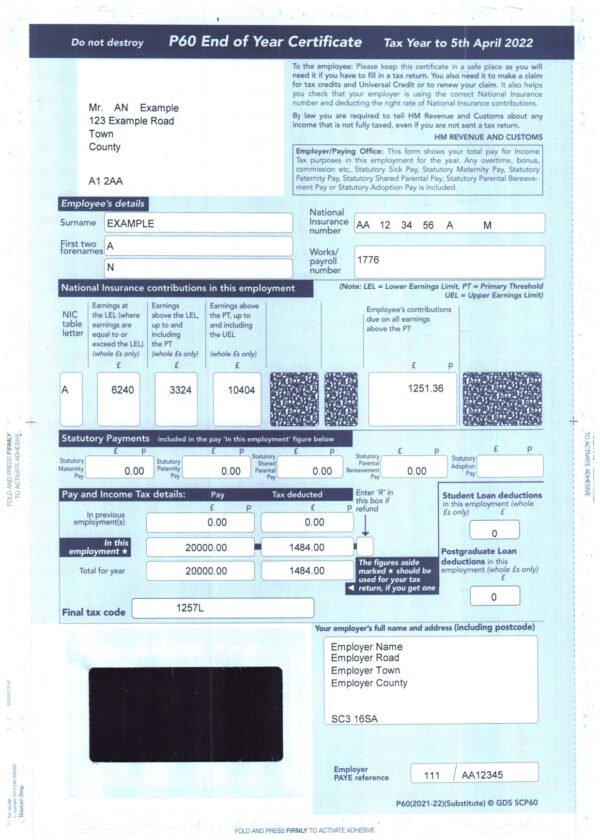

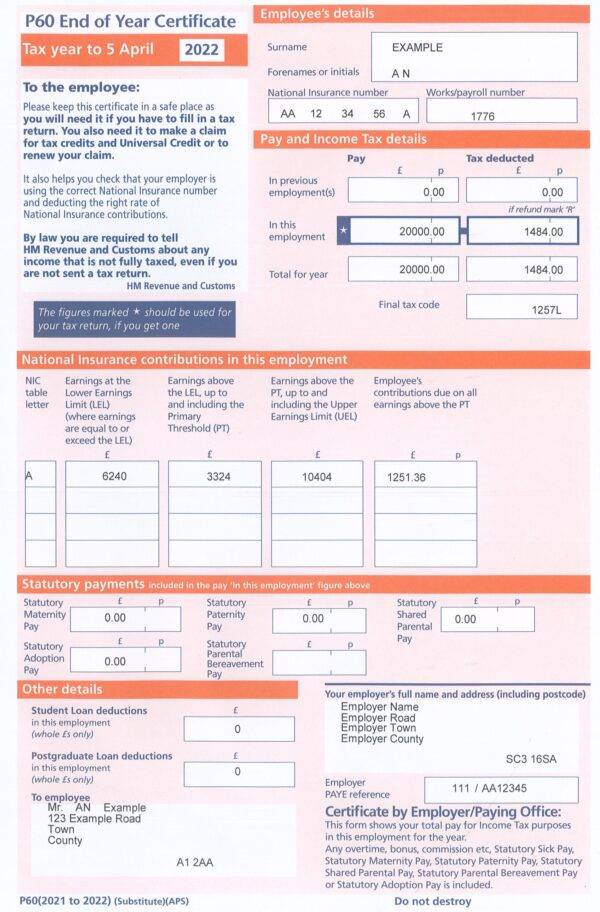

A P60 certificate provides a comprehensive summary of an employee’s total earnings and deductions for the tax year. It covers the financial period from April 6th to April 5th of the following year and is issued immediately after the tax year ends. The figures on the P60 should align with the year-to-date amounts on your final payslip of the year. This document is often required when applying for loans or contracts, renting a property, verifying employment, or for inclusion in a financial and credit report package. It is crucial to keep your P60 confidential and secure.

Replacement Of P60 Form Online

Let’s be very clear from the start: you cannot get an official “replacement P60 form” from HMRC.

However, you can get all the information from it online, or you can get a replacement document from your employer online.

Here are your options, ranked from best to worst.

Your Employer’s Online Payroll Portal (The Best Way)

This is the fastest and most official way to get your P60 online.

- How it works: Most modern companies (even small ones) use online payroll software. This is the website you use to check your payslips, book holidays, or update your personal details.

- What to do:

- Log in to your company’s employee portal or payroll system (this might be through a service like Workday, Sage, BrightPay, Xero, etc.).

- Look for a section named “Documents,” “Payslips,” or “Tax Documents.“

- Your P60s from previous years will almost always be stored here as a PDF. You can download or print it immediately.

If you cannot find this portal, email your payroll or HR department. Ask them: “Could you please email me a digital (PDF) copy of my P60 for the 2023/2024 tax year?”

This is your true official P60, and it’s the best document to have.

Why HMRC Cannot Just Print You a New P60

This is the biggest point of confusion, so let’s clear it up. Think of your P60 as a “certificate of earning” that your employer gives you.

Your employer (the company you work for) is responsible for running payroll. At the end of the tax year (which ends on 5th April), they are legally required to create and give you a P60 form. This document summarises your total pay and the total tax you paid in that job for that year.

Your employer sends all this data (the numbers) to HMRC. HMRC records the numbers, but they do not keep a copy of the actual, physical P60 document that your employer printed or emailed to you.

That is why HMRC cannot help. Asking them for a copy of your P60 is like asking the post office for a copy of a birthday card someone sent you last year. The post office delivered the card (like HMRC processes the data), but they did not keep a copy of it.

Your First Step: Contact the Employer Who Issued Your P60

The quickest and most reliable way to get a replacement P60 is to start with the employer who originally gave it to you. In many cases, this solves the problem instantly.

If you are still employed:

Get in touch with your payroll team, HR department or your line manager. They can usually reprint your P60 or send a digital copy directly from their payroll system. Requests like this are routine, and companies handle them all the time.

If you have left the company:

It may take a little longer, but this is still your main route. Reach out to the payroll department of your previous employer and ask for a copy of your P60 for the tax year you need.

Most employers in the UK are required to store payroll records for several years typically at least three years after the end of a tax year which means they should still have access to your details. When requesting your replacement, be polite and provide clear information such as your full name, National Insurance number and the specific tax year the P60 relates to.

Why Do I Even Need This Old P60?

People need their P60 form for many important reasons. These documents are proof. Imagine you are trying to get a mortgage for a flat with a view of The Shard in London. The lender needs to know you can afford the payments. Your P60 proves your income for the last few years. Or maybe you are sorting out your Self Assessment tax return. You need the P60 to declare the tax you have already paid on your employment, so you do not pay it twice.

What if you are applying for tax credits or checking your state pension forecast? The numbers on your P60 are vital. It is not just a random piece of paper; it is the official summary of your financial year. From someone applying for a rental near the Angel of the North to someone finalising a pension near Edinburgh Castle, this document is a key piece of your financial life.

Where Can I Find My p60?

Your employer will issue you a p60 form, which HM Revenue and Customs will generate. The P60 form shows you how much you’ve made and how much you’ve paid in National Insurance contributions or income tax. After the year, the taxpayers are given an End Of Year Certificate.

Here are the most common places to look, starting with the most likely.

1. From Your Employer (The Primary Source)

Your employer is legally required to give you a P60 by 31 May each year, as long as you were working for them on 5 April (the end of the tax year).

- Digital/Online Portal: Most companies now issue P60s electronically. The first place you should always check is your company’s online payroll system or employee portal. It is likely stored there as a PDF you can download.

- Paper Copy: Some employers still provide a physical paper copy.

- Email: Your employer might have emailed it to you as a password-protected attachment.

If you have lost your P60, your first step should always be to ask your employer’s payroll department for a replacement.

Your HMRC Personal Tax Account

This is the best alternative if you cannot get a copy from your employer.

- It contains the information, not the document: To be clear, HMRC does not store a copy of your actual P60 document.

- What it does have: Your online HMRC account contains all the same information from your P60. You can log in and see a complete summary of your pay, the income tax, and the National Insurance you paid for any given tax year.

You can view and print this employment history, and it is widely accepted as proof of income for things like mortgage or loan applications. You can access this by:

- Going to the GOV.UK website.

- Signing in to your Personal Tax Account (using your Government Gateway ID).

- Navigating to the “Pay As You Earn (PAYE)” section.

Your Pension Provider

If you are receiving a workplace or private pension, your pension provider will send you a P60 for your pension income. This is often available on their online portal, just like with an employer.

Clearing Up the Confusion: P45 vs P60 vs Payslip

Tax forms can be very confusing. Let us make it simple so you know exactly what you are looking for.

- P60 (End of Year Certificate): You get this once a year. You only get it if you are employed by a company on 5 April (the last day of the tax year). It covers the whole twelve months.

- P45 (Leaving Details): You get this once per job, only when you leave. It shows your pay and tax only up to the day you walked out the door. You usually give this to your next boss.

- Payslip (Regular Pay Record): You get this every time you get paid (weekly or monthly). It only proves income for that short period.

Why Employees Lose Access To Their P60

Several small issues commonly lead to missing P60s:

You changed address and the employer posted it to an old property.

You moved jobs before the P60 was issued.

Your employer switched payroll systems.

You never received the document in the first place.

Your paper copy was damaged or lost.

Because these things happen more often than you might think, many people search for a copy of my P60 from HMRC each year. Understanding the correct process saves time and avoids frustration.

Is It Possible To Download A P60 Online?

You can download a digital P60 only if your employer uses an Online Payroll Portal that stores past documents. Many modern companies offer employee accounts where you can view:

Payslips

P60 payslips

year-end summaries

employment details

If you still have access to the portal, this can be the fastest way to retrieve a missing P60.

Frequently Asked Question

Can I get a copy of my P60 from HMRC if my employer refuses to help?

HMRC cannot issue a P60, even if your employer is unhelpful. You can request a tax summary, but you may still need alternative documentation such as replacement payslips or a recreated P60 payslip.

How long does it take to get a duplicate P60 from an employer?

Most employers can issue it within a few days, especially if they use digital payroll software. Older records may take longer if they must be retrieved manually.

Can lenders accept documents other than a P60?

Many lenders accept wage payslips, year-to-date summaries or employment proofs, but requirements vary. Always check before submitting documents.

What if I worked for multiple employers in one year?

Each employer must issue its own P60. If you cannot contact them, alternative documents may be needed to show your full income.

What if the details on my P60 are wrong?

If you find an old P60 and the name, National Insurance number, or pay figures look wrong, you must contact your employer immediately. They need to fix their payroll records and tell HMRC about the mistake, or you might end up paying the wrong amount of tax.

Can I use my HMRC tax year overview instead of a P60?

In some cases, yes. A tax year overview from HMRC shows your total income and tax paid for the year and is often accepted by accountants or lenders when a P60 is unavailable.

Does a P60 show bonuses and overtime?

Yes. A P60 includes your total taxable pay for the entire tax year, which means bonuses, overtime, and other taxable earnings are all combined into the final figures.

What happens if I never received a P60 at all?

If you were employed and did not receive a P60 after the tax year ended, your employer is legally required to provide one. If they fail to do so, you can still use HMRC income records or obtain a professionally recreated P60 using accurate payroll figures.

Final Words

Getting a copy of my P60 from HMRC is a common concern, but the solution usually starts with your employer. HMRC keeps tax data but does not reissue employer documents. If your workplace has closed, lost your records or cannot provide a duplicate, you still have practical alternatives to verify your earnings. Replacement payslips, P60 payslips, wage payslips and duplicate payslips from trusted specialists like Payslips-Plus offer a clear path when official paperwork is unavailable.

A well-organised set of payroll documents protects you against delays, tax questions and financial stress. Use the steps in this guide to secure the records you need and keep your employment history complete.