Losing an important payroll document can be stressful, especially when you urgently need it for a mortgage application, rental agreement, loan approval, visa process, or financial verification. Payslips serve as official proof of income, and without them, many UK employers, agencies, and financial institutions cannot process your request.

If you’re wondering how to obtain a replacement payslip, the process is far simpler and quicker than most people realise especially with the help of trusted UK-based professional replacement payslip providers.

This guide explains everything you need to know, including your options, how Payslips-Plus can help, the benefits of professional payroll document services, and what to expect during the replacement process.

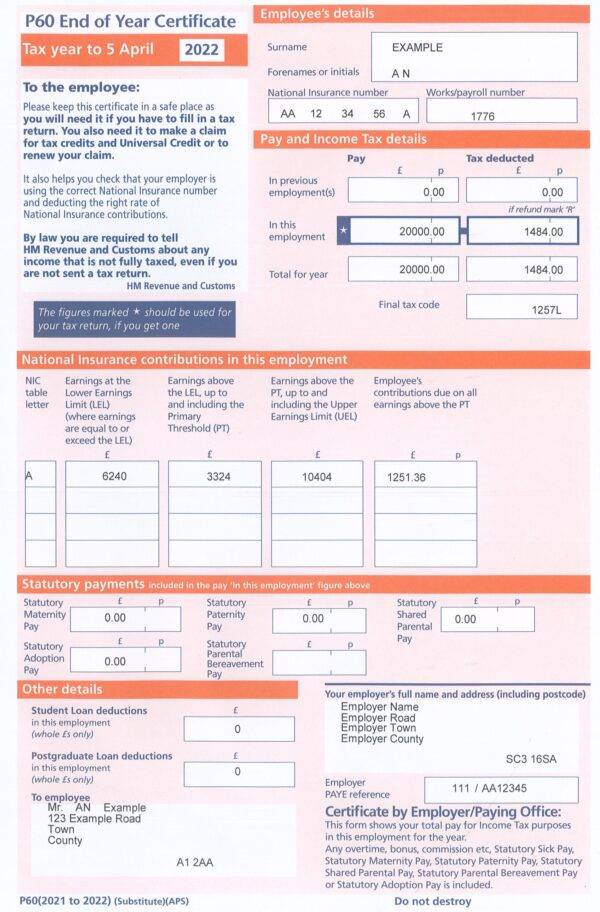

But what happens when these vital documents go missing? Misplacing or accidentally destroying wage payslips is a common problem that can cause significant stress. The good news is that it’s almost always possible to get a copy. This comprehensive guide will walk you through the professional and official channels for obtaining Replacement Payslips and a replacement P60 Online, ensuring you have the documentation you need, when you need it. We will explore the various routes you can take, from contacting your employer to leveraging a professional Payroll Service UK.

Why You Might Need Replacement Payslips or a P60

The need for a replacement payslip or P60 can arise for numerous reasons, often at the most inconvenient times. Understanding why these documents are so important clarifies the urgency of replacing them.

- Proof of Income for Loans and Mortgages: This is the most common reason. Lenders require a detailed history of your earnings (typically the last 3-6 months of payslips) and your most recent P60 to verify that you have a stable income to meet an affordability assessment. Without these, your application will almost certainly be delayed or rejected.

- Tenancy Agreements: Landlords and letting agencies require proof of income to ensure you can afford the rent. Replacement payslips serve as the primary evidence they will ask for.

- Tax and Financial Queries: If you are filing a self-assessment tax return, querying your tax code, or claiming a tax rebate, your payslips and P60 provide the definitive record of your earnings and tax paid. HMRC may request these documents during an inquiry.

- Personal Record-Keeping: It is simply good financial hygiene to keep a complete record of your employment history. These documents are crucial for checking your pension contributions, National Insurance contributions (which affect your state pension), and ensuring you have not been over or under-taxed.

- Visa and Immigration Applications: Many UK visa applications, especially those for partners or for permanent residency, require extensive financial evidence to prove you (or your sponsor) meet the minimum income threshold.

Losing these documents is not a dead end. Whether you need a single wage slip or a full year’s worth of payslips, a clear process exists for their retrieval.

Why You May Need a Replacement Payslip

Many people misplace their payslips, damage them, or never receive a copy due to employer delays or payroll errors. A replacement payslip may be required for:

Proof of income for mortgages or loans

Rental applications and tenancy checks

Visa and immigration requirements

Tax purposes and PAYE/National Insurance verification

Personal record-keeping

Employment disputes or HR documentation

Regardless of the reason, replacement payslips must be accurate, professionally formatted, and aligned with UK payroll standards.

Use a UK Professional Replacement Payslip Service

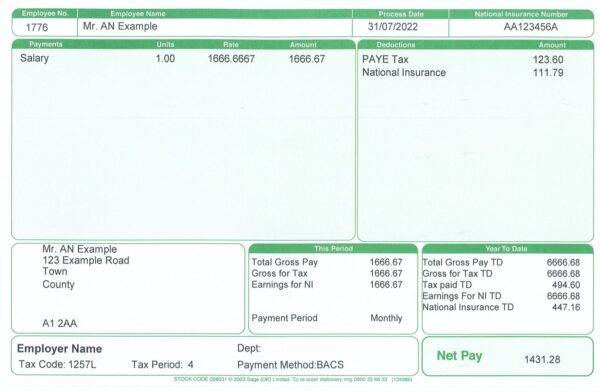

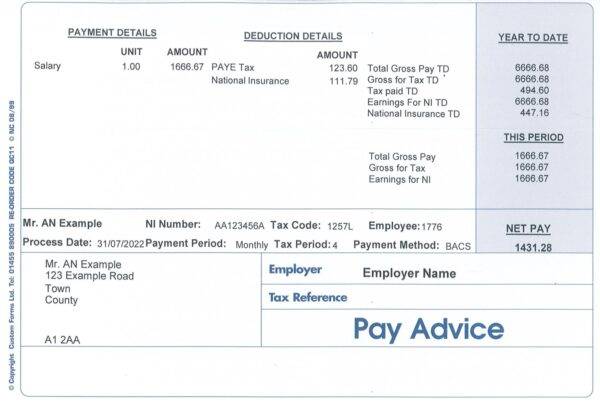

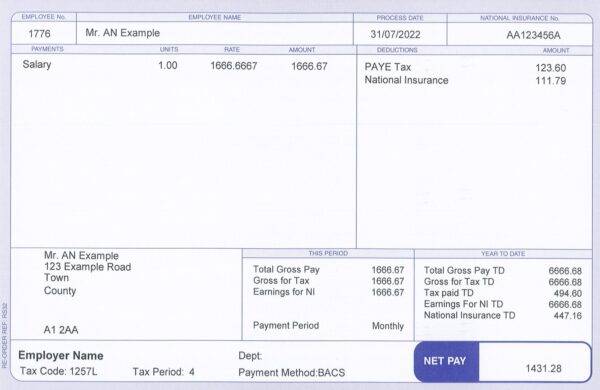

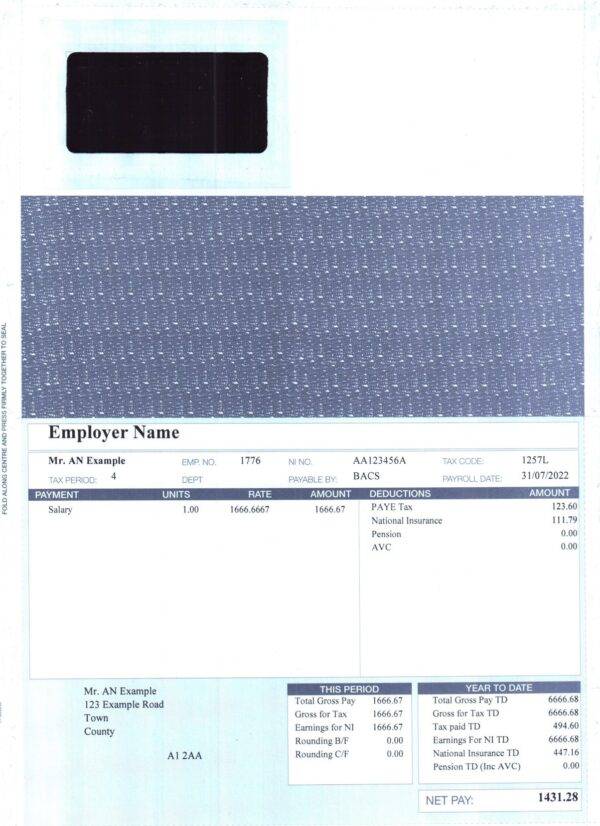

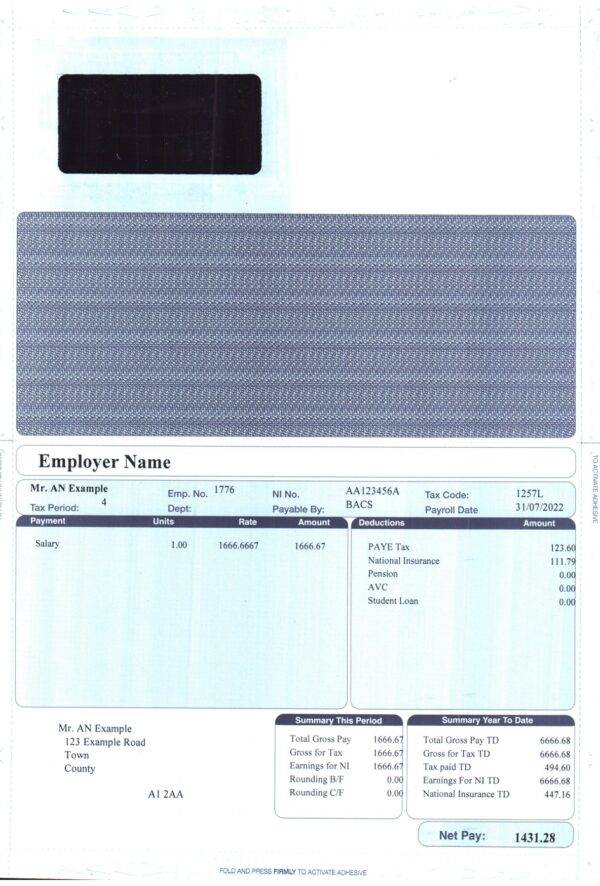

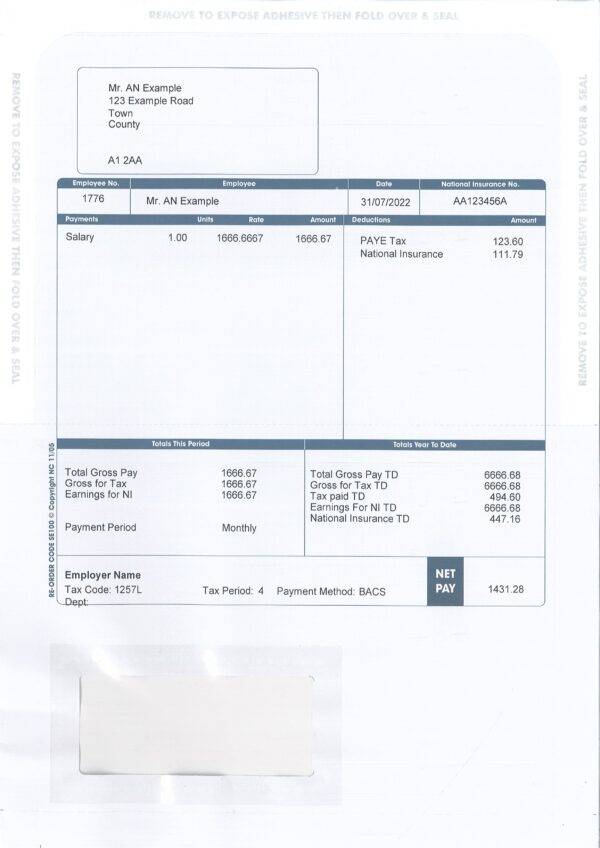

Companies such as Payslips-Plus specialise in providing accurate, securely printed, and fully customised replacement payslips that reflect your pay details, deductions, and HMRC-compliant formatting. These services offer fast turnaround times and are ideal for individuals needing immediate income verification.

Key features include:

Laser-printed payslips

Digital PDF payslips for instant download

Accurate PAYE and National Insurance deductions

Customisable pay dates, employer details, and salary figures

Confidential and secure processing

Same-day service available

How Payslips-Plus Helps You Obtain a Replacement Payslip

Payslips-Plus is a trusted UK provider specialising in Replacement Payslips, P60 forms, P45s, and other payroll documents. They offer a fast and professional solution when employers are unable to assist or when customers need urgent, well-presented records.

Here’s how the process typically works:

Choose Your Payslip Type

You can select from various options including:

Monthly, weekly, or fortnightly payslips

Standard or premium laser-printed payslips

Digital PDF or physical postal delivery

Enter Your Payroll Information

You will need to provide details such as:

Employer name and address

Your full name and job title

Gross pay, net pay, and deductions

Pay period date(s)

Tax code, NI category, and PAYE details

This data allows the system to produce a realistic and properly formatted UK wage slip.

Review and Approve Your Details

The provider ensures accuracy and verifies that the details align with standard HMRC payroll guidelines.

Receive Your Replacement Payslip

Delivery options typically include:

Instant digital download (PDF)

Same-day dispatch for printed copies

First-class or tracked UK delivery

This makes it quick and simple to replace Lost Payslips.

Why Choose a Professional Replacement Payslip Plus UK Provider?

Speed and Convenience

When you need proof of income urgently, waiting for your employer is not always practical. Professional services often offer same-day production.

HMRC-Style Formatting

Payslips must follow UK payroll structure. Providers like Payslips-Plus ensure the correct layout, deductions, and employer information.

Confidential and Secure

Your personal and financial details are handled with strict confidentiality, and documents are never shared with third parties.

Accurate Payroll Calculations

PAYE deductions, National Insurance contributions, gross pay, net pay.

Suitable for a Range of UK Applications

Replacement payslips can support:

Mortgage and loan applications

Rental income checks

Visa and immigration reviews

Employment verification

HR/payroll disputes

FAQs:

Can I get a replacement payslip if I no longer work for the employer?

Yes. If your former employer cannot provide copies, a professional payslip service can recreate accurate replacement documents for your records.

How long does it take to receive a replacement payslip?

Digital versions can often be delivered Instantly, while printed copies may arrive next-day depending on postage.

Will my replacement payslip look like an official UK payslip?

Yes. Payslips-Plus uses professional laser-printed formats that resemble traditional employer-issued wage slips and follow UK payroll standards.

Can I order multiple payslips at once?

Absolutely many customers order full monthly sets for an entire tax year or specific periods needed for financial applications.

What if I need other payroll documents?

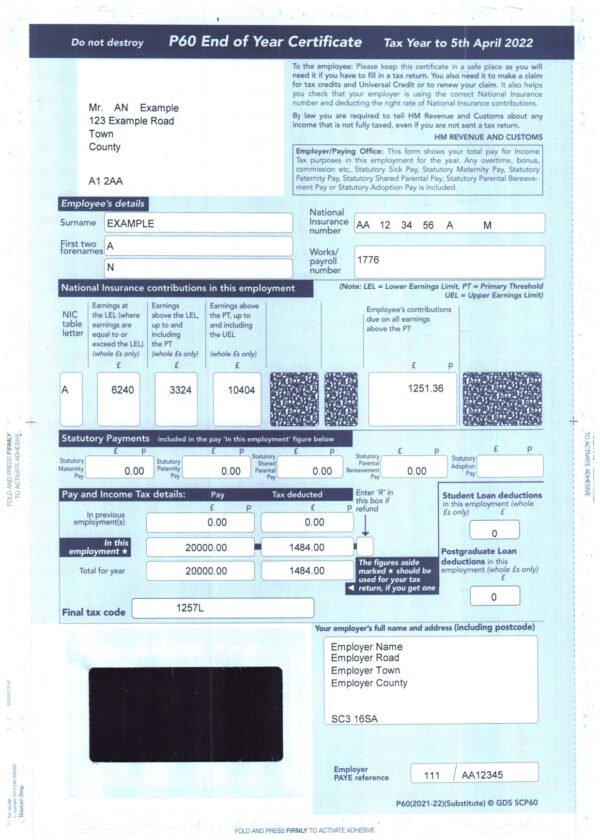

Payslips-Plus also provides:

Replacement P60

Replacement P45

Proof of income letters

Customised payroll documents

Can I get a replacement payslip if I no longer work for the employer?

Yes. If your former employer is unable or unwilling to provide copies, a professional payslip service can recreate accurate replacement documents for your personal or financial records.

How long does it take to receive a replacement payslip?

Digital payslips can often be delivered instantly after details are confirmed. Printed copies may be available with next-day delivery, depending on the service and postage option chosen.

Will my replacement payslip look like an official UK payslip?

Yes. Professionally recreated payslips follow standard UK payroll layouts and include all required information, such as gross pay, deductions, and net pay, matching the format used by employers.

Can I order multiple payslips at once?

Yes. Many people request multiple payslips covering specific months or an entire tax year, especially for mortgage, rental, or loan applications.

What if I need other payroll documents besides payslips?

In addition to payslips, many services can also help with replacement P60s, P45s, or earnings summaries, allowing you to gather all required payroll documents in one place.

Conclusion:

Knowing how to obtain a replacement payslip can save you time, stress, and complications when handling financial or legal matters. Whether your employer cannot assist or you simply need urgent, professionally formatted documentation, UK providers like Payslips-Plus offer a fast, reliable, and secure solution.

With same-day digital delivery, accurate payroll calculations, and HMRC-style formatting, the process of replacing lost or damaged wage slips has never been easier. If you’re preparing for a mortgage application, tenancy check, visa requirement, or personal record update, obtaining a high-quality replacement payslip ensures you have the documentation you need when you need it.