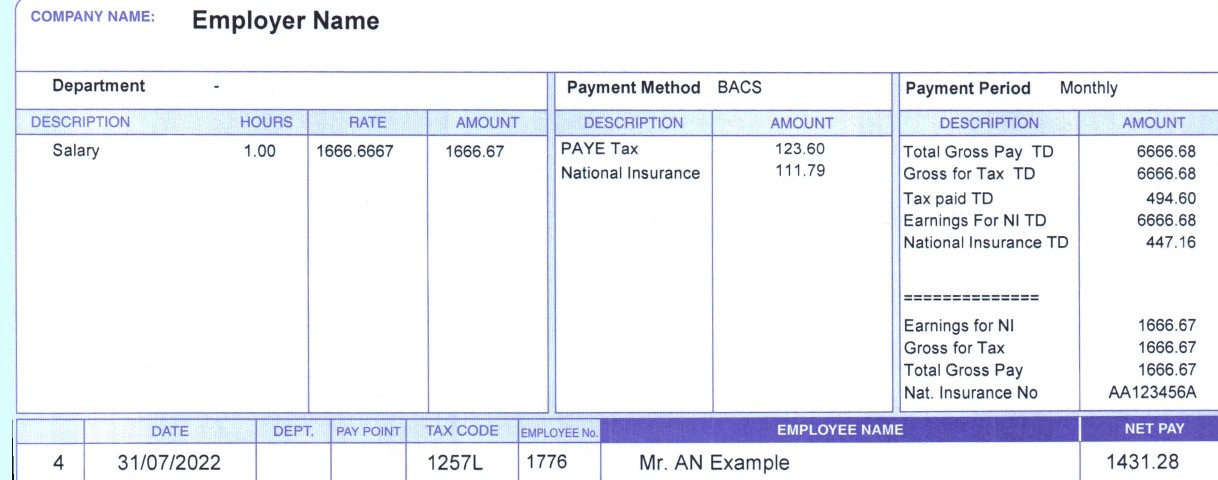

Payslips are vital documents that provide a record of an employee’s earnings, hours worked, tax deductions, and other financial details. Employers are generally responsible for retaining payslip records, even after an employee has left the company. If you need to access a copies of old payslips, the first step is to contact your former employer. They typically have the records you need and can provide you with a copy upon request. If that’s not possible, you may have to rely on any personal records you’ve kept or seek alternative solutions to reconstruct your financial history.

Order your old payslips p60 here same day delivery

Why do you need old payslips?

Old payslips are more than just pieces of paper or PDFs. They can help you:

-

Prove your income when applying for loans, mortgages or rental agreements.

-

Check that your tax, national insurance and pension contributions were taken correctly.

-

Keep a record of your employment history and changes to salary or hours.

-

Sort out missing pay, holiday pay or deductions after you leave a job.

For residents in places like London, Manchester or Birmingham, having organised payslips can save time when dealing with banks or agencies.

What are your rights when it comes to payslips in the UK?

Your rights around payslips involve several laws and regulations:

Your employer must give you a payslip

Under the Employment Rights Act 1996 your employer must provide you with an itemised payslip either on or before payday.

That payslip must show:

-

Your earnings before deductions (gross pay)

-

Your earnings after deductions (net pay)

-

Any deductions that may vary such as tax and National Insurance

-

If your pay varies by time worked, the number of hours you worked must be shown.

How Long Do Employers Keep Payroll Records?

UK employers are required to keep accurate payroll information, including what they pay employees, the deductions taken and the reports submitted to HMRC. In most cases, payroll and tax records — which include payslips, P60s and related documents are kept for up to six years from the end of the tax year they relate to. This record-keeping requirement helps ensure transparency, supports tax enquiries and allows employees to request information when needed.

Are Employers Required to Provide Old Payslip Copies?

Not always. While employers must store payroll data for several years, there is no legal obligation for them to reissue past payslips on demand. Many employers will provide copies as a courtesy, but it is not guaranteed. If your employer cannot supply older payslips or no longer holds your records, you can still request professionally recreated replacement payslips through Payslips Plus to help with income verification or documentation needs.

They may have them, or they may not, especially if many years have passed.

Frequently Asked Question

What if I lost my payslips entirely?

Request copies from your employer. If they cannot locate, ask for a “statement of earnings” or ask HMRC for tax year summaries and cross-check.

What if I only worked for a short time and the employer no longer exists?

A: Contact the former employer’s registered company address. If the company has been dissolved, you may still use pay records you kept (bank statements) plus declare that you attempted to obtain payslips.

Do digital payslips count?

A: Yes. The law allows electronic format as long as you can access and print them.

How long do I need to keep my payslips?

A: It is wise to keep them for at least six years, since many employment and tax issues go back that far.

Summary: What to do now

-

Check whether you already have the payslips you need.

-

Contact your former employer with full details of the period and what you need.

-

If they cannot supply them, ask for alternative documents and check HMRC records.

-

Keep future payslips safely to avoid this problem later.

-

Use your rights under employment and data protection law if necessary.

By following this process you will have a strong chance of retrieving your old payslips or a suitable alternative. This will give you the confidence and documentation you need for jobs, housing, pensions or any later financial requirement.

Don’t be afraid to call us for assistance. We’re happy to answer your questions and provide any information you need. Just call us at 0845 052 9692 or use our online contact form.

I lost my payslips from my old company. Can I re-reply by asking for them?

Yes. You can ask your former employer to send you your old payslip. However, they may not be able to send them to you. They may be in the process of destroying them.